RBI: The Climate Strikes Back!

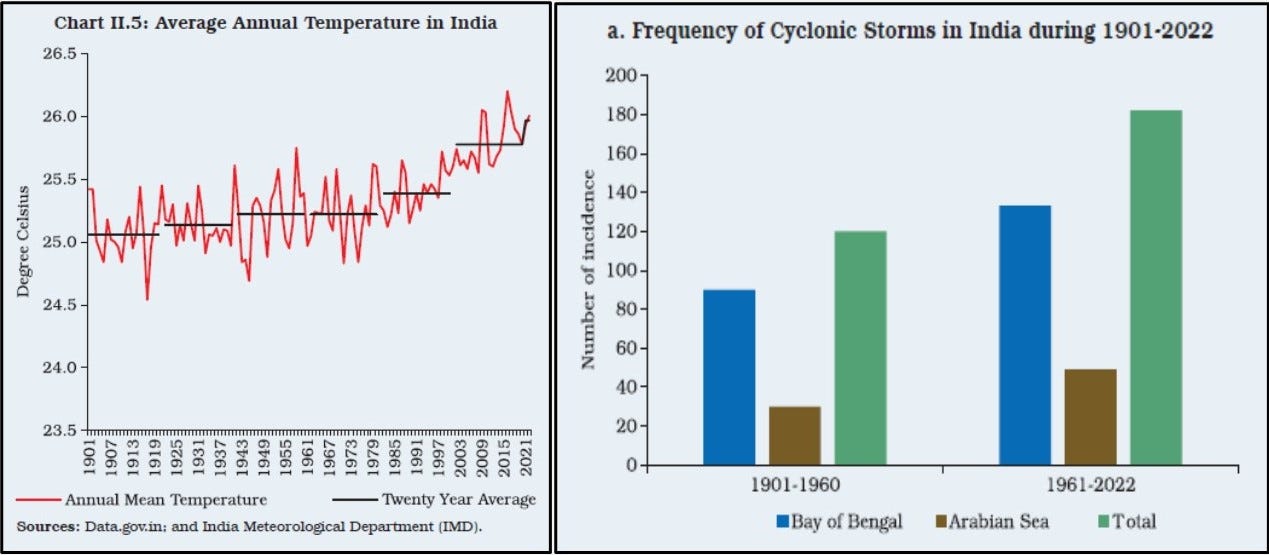

The latest Reserve Bank of India (RBI) Report on Currency and Finance is a must read for everyone, a data rich, evidence backed report on why we need to adapt to climate change that is already on us. For our readers cued into financial inclusion, the RBI has highlighted the stress on household finances from adverse effects of rising temperatures - the changing pattern of the monsoon, heatwaves, cyclones, flash floods, rising sea level etc. At this juncture when India has successfully addressed the challenge of providing access to banking and establishing a retail digital payment ecosystem that is growing manifold, a more granular approach to financial inclusion is now on the cards. For example, as Howard Miller’s post explains, appropriate products like small loans and parametric insurance can help vulnerable segments get through the deadly heat waves that are already impacting India. At Indicus we have already begun work in this intersection of climate change and financial inclusion and will update as we go along.

One of the regulatory challenges with digital financial services continues to be in the lending space, the industry is adapting to the framework set out by the RBI. Arti Singh puts out a detailed report on the trend in fintechs towards merger and acquisition deals as the industry grapples with the RBI crack down on the First Loss Default Guarantee (FLDG) model, - "fintechs are buying NBFCs and many NBFCs are trying to mop up fintechs." Fintechs are also expanding their inhouse compliance expertise to stay aligned with the regulatory environment.

When it comes to digital lending apps (DLAs), action continues with Google putting in stringent disclosure and compliance policies in place for listing on Playstore, after taking action against 3500 DLAs last year. Against the backdrop of the abrupt ban with its subsequent revocation by MEITY (Ministry of Electronics and Information Technology) early this year and lack of regulatory clarity, couple of suggestions from Vivan Sharan and Ateesh Nandi on a business friendly approach to regulating online financial services apps include a common public registry and self-regulation by industry. Chase India has released a detailed report setting out a whitelisting framework for DLAs in India and recommending an SRO or dedicating a nodal agency within the regulator’s purview for effective implementation and enforcement.

Ram Rastogi has written a LinkedIn post on the importance of AePS (Aadhaar-enabled Payment System) in expanding financial inclusion, where he noted that recently, the system has been facing issues related to the transactions (number of withdrawals and amounts) on all corporate BC (business correspondent) networks, and there were complaints that AePS withdrawals were not working for certain large public sector banks. There must be a collaborative approach towards ensuring that the usage of accounts is strengthened. In our Indicus White Paper on authentication failures, one of the recommendations was for the Ministry of Finance to take the lead and coordinate between all stakeholders to put in place SOPs for AePS transactions such that the reasons for failures are identified and addressed.

Some positive news coming in from India’s Bank Sakhi programme that aims to increase the number of rural women business correspondents towards closing the gender gap in financial inclusion. Cristina Martínez, Amit Arora and Anand Raman from CGAP have shared insights from their field work undertaken in partnership with Bihar Rural Livelihoods Promotion Society (JEEViKA). They have found that while Bank Sakhis have been more effective than male business correspondents at reaching out to the most vulnerable segments like the elderly, students, disabled etc., they also suffer from operational challenges, which have been identified for the industry and government to resolve.

Do follow our Indicus Centre for Financial Inclusion page on Linkedin to continue the conversation. Read on here for more of the latest news and views on financial inclusion in India, thanks!

Grameen Foundation India released four reports covering different aspects, making a case for increasing and diversifying revenue or remuneration for business correspondents (BC) agents in India.

Arisha Salman and Maria Fernandez-Vidal, CGAP, have set out five gender-based findings on the data trails being generated by low-income individuals and give proposals for service providers and policy to address the gaps.

Rajeshwari Sengupta and Harsh Vardhan write on the changing credit landscape post-Covid in India.

Dr Rashi Gupta, Rezo.ai, writes on the need for NBFCs to shed manual loan recovery and adopt AI-driven communication tools to improve loan recovery, comply with RBI guidelines, and provide a consistent customer experience

Anand J writes on the challenges in replicating UPI's success abroad in the form of bureaucracy, financial viability, competition from similar platforms etc.

Harshil Mathur, Razorpay writes on the potential of Indian fintech going global and foresees "Indian fintech as the default service provider for the world."

Open Network For Digital Commerce (ONDC) and McKinsey & Company released a report presenting the vision, architecture, and road map of ONDC. It highlights some early experiments and spotlights the exciting use cases ONDC could unlock. It describes the benefits and opportunities ONDC could create for different stakeholders—sellers, buyers, platforms, and service providers—while also laying out important actions these stakeholders could take to reap the benefits from this pioneering initiative.

Dr. Vinay Kumar Singh, MFIN, writes on meeting the financial needs of the low-income customer.

PayNearby partners with Rajasthan Grameen Aajeevika Vikas Parishad (RAJEEVIKA) to onboard 10,000 women business correspondents in Rajasthan.

Airtel Payments Bank and NPCI collaborate to roll out Face Authentication for AePS (Aadhaar-enabled Payment System) at its 500,000 banking points.

Jayshree Venkatesan, Center for Financial Inclusion (CFI) summarizes their research in a blog post on the role of catalytic capital in shaping market incentives and the need for impact-oriented investors to address consumer risks as markets mature.

Chetan Thathoo reports in Inc42 Media on the action taken last year by Google india on digital lending apps that violated the guidelines and rules.

Avinash Nair writes on the report by the Gujarat SLBC on the business correspondent network, one-third of business correspondents deployed by banks in Gujarat are inactive.

Salman SH reports on the Tracxn report on fintech funding in India. India’s fintech space, considered to be the second-largest funded ecosystem after the US, witnessed an uptick in funding.

Palak Agarwal reports on PayNearby’s survey MSME Digital Index 2023, with insights like 71% of retail MSMEs are utilising digital tools for their day-to-day operations, small business owners between the ages of 18 and 30 were the most digitally proficient, with over 75% of them using smartphones to manage their business activities and access digital content etc.